Some tips for buying a house in Liguria / Riviera di Ponente.

- Are you looking to buy a house in Italy / Liguria / Riviera di Ponente?

- Would you like to know how this works and what to look out for?

- Of course, you don't want to step into any pitfalls - why are some questions unanswered?

At the end of this recommendation you are well prepared.

Buying a house in Italy should not become an unknown adventure.

Are there the best places in Italy to buy a house?

No - rather not, because this is a matter of taste and it is well known that there is no dispute about it. In the Internet age, innumerable offers appear on so-called “real estate portals”. Never forget that a real estate portal usually does not even know an exhibited object, but only serves as an advertising medium for brokers or private sellers, and an Italian reality quickly becomes apparent:

The Italian real estate market is unsatisfactorily crumbly.

Classified ads?

In many regions is still via Classified advertised, often with unreally high asking prices from private sellers. Legal uncertainty plays a role here and an Italian / German-speaking lawyer should preferably be consulted.

Walk around and leave it to chance?

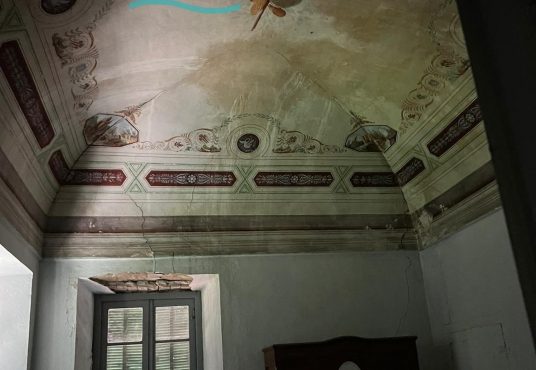

Another process is through an area move around and "from village to village" in search of "Vendesi"Signs to keep an eye out. Attention, not all properties are recognizable. Some available property does not have a sign because the owner is at an optimum Confidentiality wishes nobody should know that has to be sold! Because the economic crisis, which has lasted for more than 10 years, is forcing the “upper class” in conurbations such as Turin and Milan to take cost-cutting measures and sell their second home by the sea.

Realtor commission

A real estate agent is legally obliged to act impartially. He works on behalf of both the buyer and the seller and must have an Italian broker license. Therefore, his brokerage fee is usually paid by the buyer and seller. Each broker determines his commission rate himself. A buyer usually pays 3% up to 5% + VAT from the sales price. Always have everything checked and handled by a notary. Do not make payments directly to the broker or seller. In any case, have a preliminary contract (compromesso) entered in the land register / property register. This should especially be the case if the buyer still has to take out a mortgage loan.

- Offer proposal → 2nd preliminary contract (compromesso) → 3rd notarial deed ("Rogito", transfer of ownership)

The preliminary agreement should include the following:

- Energy performance certificate plus a copy of it and a € 16 tax stamp

- Cadastral excerpt / inspection (inquiries) including floor plan (2 € stamp each)

- Copy of the form F23with details of the tax payment

- The registration form 69

- Notary fee / if you are not proficient in the Italian language, the law requires an official translator. Negotiation matter between buyer and notary.

- The brokerage fee is due as soon as the buyer and seller sign a preliminary contract and a down payment has been made.

Notarial deed / notarial deed (Rogito notarile)

The only legally binding mediation step is the definitive transfer of ownership agreement between the parties, which must be drawn up and attested by the notary. The payment amount should be made in advance by means of Ital. Bank check be handed over to the notary. The Usesfee and transfer taxes are charged by Uses called in, he also ensures that the cadastre (catasto) and the property register are updated correctly. To the duties one Notariesthat ensure successful completion include:

- Clarify ownership

- Eg easements and rights of way, liens (mortgage, land charge), right of first refusal etc.

- check that it is a legal object and not a "black building", or conversions / additions are also registered in the land registry.

- checking the identities of the parties (buyers / sellers); ensure that they meet the legal requirements for entering into the agreement (B. Minimum age, common sense)

- the applicable tax regime confirm and collect the taxes due. Real estate transfer tax is 2% for primary residence and 9% for secondary residence of the cadastral value

- Issuing the deed of ownership ensures compliance with all applicable laws

- enclose the legal floor plan for the property

- Read the notary deed to the parties to ensure that they understand the content and that it is what they want

- collect stamp duty and taxes on behalf of the state

- Registration of transfer of ownership with Property registerand in the Land Registry (catasto)

- In order to open a bank account in Italy, a bank requires personal identification and an Italian tax number (codice fiscale). A codice fiscale that is quite easy to obtain.

Once you become a new owner, you incur some recurring costs:

- Facilities (telephone, gas, electricity)

- Condominium management costs

- only if your property is part of a condominium community

- Local garbage and service tax

- Municipal or property tax (Imposta Municipale) for services and expenses of the municipality

- does not apply if your house is your main residence- unless it is a luxury property.

- Insurance

- You should at least consider insurance that covers damage to third parties, such as when a water pipe breaks and your neighbors suffer water damage. You can also consider theft, fire, and other coverages.

- Avoid double coverage:

- If you are in a condominium community, there may be group insurance for the building.

- If you have taken out a mortgage loan, you have some risk coverage for life over the life of the mortgage loan.

Your real estate agent can provide an overview of your expected annual ownership costs.

Tax deductions

Property owners can benefit from a number of tax deductions when filing a tax return in Italy. The exact details may change from year to year. Preferably speak to an Italian. Tax Advisor (Commercialista)

- Brokerage fee

- Mortgage loan interest

- Renovation costs

- Energy saving improvements

What can the broker do for you?

- Provision after "after-sales phase" as community registration

- Activation of electricity, water, possibly gas, WiFi, insurance, waste disposal

- Bureaucratic administration.

- Maintenance work and possibly cleaning.

- Monitoring of conversions, renovations.

- Construction direction including geometer

- Report using video / photos / WhatsApp